Update: Linden Lab has now blogged on the change-over – see: A New Chapter: Tilia Joins Global Payments Leader Thunes, together with a FAQ. I have further updated this piece to include details on user data security, as given by Brad Oberwager in April 2024, as a result of being was on this subject.

On Thursday, 29th, 2025, Linden Lab Executive Chair Brad Oberwager and members of his team held a Zoom call with bloggers and creators to provide an update on the acquisition of Tilia.io, the all-in-one payments platform the Lab launched, and which handles payments processing, USD account balances, etc., for Second Life, to Singapore-based Thunes, based business-2-business (B2B) payments infrastructure firm.

The following is a summary of the core points of the discussion, some of which re-trod the subject of account security, as I’ve already covered in Linden Lab: keeping your Second Life account safe.

Acquisition and Change-Over

- The acquisition is due to complete on Wednesday, June 4th, 2025.

- On this date, there will a series of steps taken by both Linden Lab and Thunes to complete the change-over.

- Perhaps most notably, Second Life web pages referencing Tilia Inc., will instead reference Thunes Financial Services LLC, and the Tilia website will be rebranded.

- While there are chances of some hiccups given the back-end complexity of the change, these should be minimal, and the SL support teams will be ready to help any users who may experience issues.

- In short: “Don’t Panic” when/if you see the changes happening.

What This Immediately Means to Users

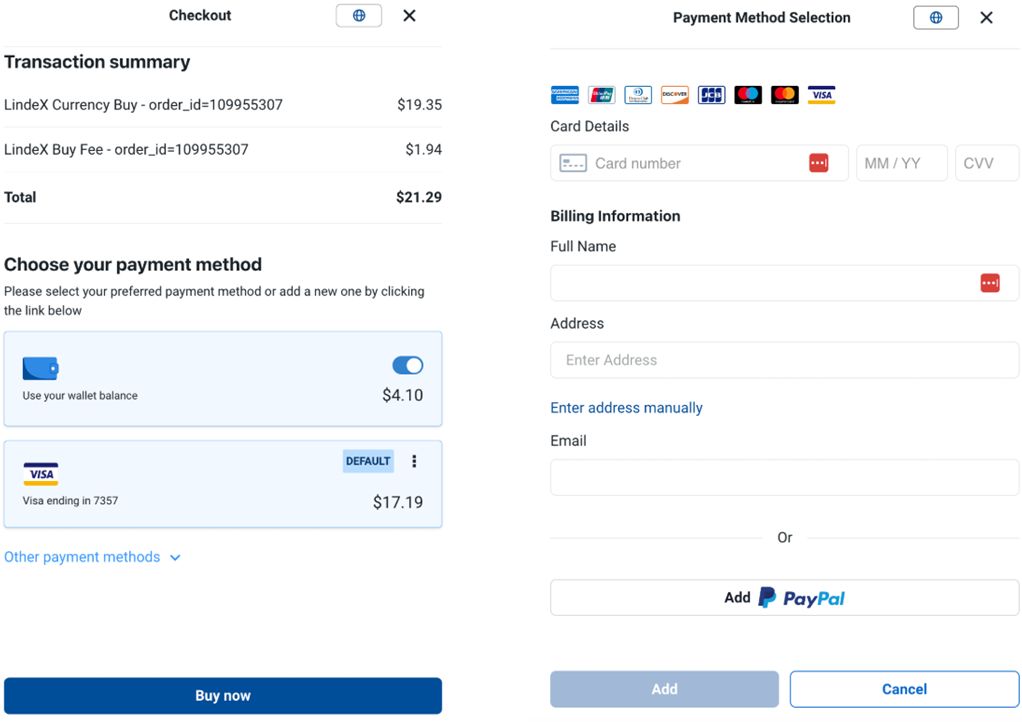

For the majority of users, there should be no visible difference to the processes of buying L$ or cashing-out.

- User Data Security: An important point to note with the acquisition of Tilia is that Second Life user data is not changing hands.

- Tilia will have new owners and will be renamed, but the lock-down of Second Life user data resides in two places: Tilia (for financial information) and Second Life (actual user data).

- As a financial services company, Thunes is required to keep financial data as secure as it currently is with Tilia, and the data will not be removed from the current Tilia systems and moved elsewhere.

- There will be no changes in existing fees charged by the Lab for cashing-out or buying L$.

- No-one needs to create an account with Thunes to keep buying L$ or cashing-out, etc.

- There will be no change in how support issues relating to finances are handled: users will continue to deal with the Lab’s own billing support team. you will not have to deal with Thunes directly.

- Linden Lab will continue to manage the LindeX, and nothing will be changing on this front.

- However:

- Following the change-over, users may be required to acknowledge the change via a check-box the first time they engage with the rebranded service.

- Some users may have to re-submit information such as their credit card details or re-confirm a payment account as a result of the change-over.

What It Means Going Forward

- Potentially more methods by which to receive payments from Second Life (e.g. to different accounts, through different services, etc.) or by which to purchase L$ – Thunes supports pay-outs across 130+ countries and 320+ payment methods globally.

- It is possible that as new payment methods are added to Second Life, they may be subject to increased fees as a result of charges made by the payment method.

- To aid in understanding of fees charged, the Lab will start to provide a breakdown: how much they are charging & how much of that due to the payment method. This is to allow users to decide whether they wish to use a newer payment method, which might offer certain advantages (e.g. faster processing), or not.

- LL has a 5-year agreement with Thunes to prevent Thunes forcing increases on existing services provided to LL (although this obviously does not prevent LL making changes to fees should they need to).

- Much better fraud controls and investigation, leveraging Thunes own capabilities as well as LL’s support team.

Benefits to Linden Lab

- The company is no longer engaged in trying to operate and maintain what is essentially a fintech company, with all the costs involved therein.

- Ability for management to focus solely on building and improving Second Life.

- The payments team can be focused solely on Second Life, rather than having to also focus on regulatory requirements and deal with multiple payment services, etc., as these will now be the responsibility for Thunes to manage.

Related Links

- A New Chapter: Tilia Joins Global Payments Leader Thunes – Linden Lab

- Thunes acquisition FAQ.

- Linden Lab to sell payments platform Tilia to Thunes – April 23rd, 2024 this blog

- Thunes Press Release on Tilia Acquisition – April 23rd, 2024

- Second Life’s Lab Gab – Tilia Acquisition with Oberwolf Linden – You Tube, April 2024

- Summary of Tilia acquisition Lab Gab + SL Round Table News – this blog

- Tilia website