MENLO PARK, CALIF. – March 25, 2014 – Facebook today announced that it has reached a definitive agreement to acquire Oculus VR, Inc., the leader in immersive virtual reality technology, for a total of approximately $2 billion. This includes $400 million in cash and 23.1 million shares of Facebook common stock (valued at $1.6 billion based on the average closing price of the 20 trading days preceding March 21, 2014 of $69.35 per share). The agreement also provides for an additional $300 million earn-out in cash and stock based on the achievement of certain milestones.

So opens a press release issued by Facebook on Tuesday March 25th, 2014.

This is a pretty stunning announcement, and shows that, as Mark Zuckerberg states in the release, “Mobile is the platform of today, and now we’re also getting ready for the platforms of tomorrow. Oculus has the chance to create the most social platform ever, and change the way we work, play and communicate.”

The news has sent shock waves rumbling across the social media sphere, with many reacting positively to the news, and other reacting negatively. Following the announcement, Cory Ondrejka at Facebook was unsurprisingly excited by the news.

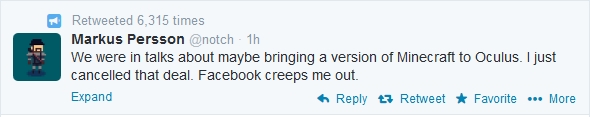

While Markus Persson of Minecraft fame responded to the news with as less favourable response, which was quickly picked-up by the games media.

Others also didn’t appear to be initially impressed by the news, either, including those who funded the original kickerstarter. Meanwhile, Techcrunch reported a slide on Facebook’s share price which, while closing on the day overall, saw Facebook’s share value below its open price of $64.25, resulting in a loss of $1.5 – $1.8 billion market cap. However, as Techcrunch also notes, this isn’t the first time Facebook’s shares had dropped following the announcement of an acquisition.

Theories as to why Facebook have made the move abound, with some pointing to the company tripping-up on the explosion of the mobile market and so are perhaps afraid they might miss-out on the growth of VR if it takes off suddenly. Others are suggesting Facebook is keen to jump on the possible marriage of the Oculus with mobile technology.

I’ve been somewhat skeptical that VR will explode in quite the immediate way many have been predicting – which is not to say I don’t think it will be big; I just think it’ll take longer to get there on all fronts (i.e. beyond gaming) than some pundits are perhaps allowing. It seems I’m not alone in thinking this. Speaking to The Verge, Oculus investor Chris Dixon believes Facebook are playing the long game – rather like Google did with their acquisition of Android in 2005.

It appears Zuckerberg agrees with him. Commenting in a teleconference held on the afternoon on March 25th to discuss the acquisition, Zuckerberg said, “There are not that many companies building technologies that could be the next computing platform, and Oculus is the clear leader.”

In this regard, Zuckerberg went on to say:

But this is just the start. After games, we’re going to make Oculus a platform for many other experiences. Imagine enjoying a court side seat at a game, studying in a classroom of students and teachers all over the world or consulting with a doctor face-to-face — just by putting on goggles in your home.

This is really a new communication platform. By feeling truly present, you can share unbounded spaces and experiences with the people in your life. Imagine sharing not just moments with your friends online, but entire experiences and adventures.

Concerns have already been raised over the future of Oculus Rift as an open platform, something Oculus VR founder Palmer Luckey attempted to allay in a statement on the company’s Reddit page:

Facebook is run in an open way that’s aligned with Oculus’ culture. Over the last decade, Mark and Facebook have been champions of open software and hardware, pushing the envelope of innovation for the entire tech industry. As Facebook has grown, they’ve continued to invest in efforts like with the Open Compute Project, their initiative that aims to drive innovation and reduce the cost of computing infrastructure across the industry. This is a team that’s used to making bold bets on the future.

Whether such comments will quell concerns and upset, remains to be seen, although i’m not putting money on it doing so. Facebook undoubtedly have the financial and technical clout to boost Oculus Rift and VR into more mainstream consciousness. Whether this will come tied to a Facebook log-in requirements, again as some are already predicting, remains to be seen.

It’ll also be interesting to see how Facebook, after dabbing with virtual world environments through Cloud Party, consider virtual worlds, and the direction in which they might move. Could it be the “Facebookisation” of SL (or rather, perhaps, Linden Lab) may yet come to have a significantly new meaning? Or, less tongue-in-cheek, what about Philip Rosedale’s High Fidelity coming under the FB eye? Now there’s something to chew on (ETA: and in this regard, Palmer Luckey’s sign-off to his blog post announcing the acquisition is interesting: We’ll see you in the Metaverse!)

P.S. Techcrunch may score the biggest hit in this latter regard with their latest headline on the subject: Facebook Buys A Virtual World – that’s bound to get people rushing to their doors!

With thanks to Luke Plunkett at Kotaku.

Really disappointing news. People are furious on the Oculus blog and there are some very unhappy campers on the Kickstarter page, this is not good news for Kickstarter either, this isn’t why people fund Kickstarter projects.

LikeLike

Yup. I’ve linked to the reactions on the Kickstarter page. May also explain why Gabe Newell manoeuvred clear of the Rift as well.

LikeLike

Who maneuvered closer to the Rift than Gabe and Valve? They were instrumental in Crystal Cove and the new DK. And Valve lost two key VR employees just this month in Atman Binstock and Tom Forsyth. Michael Abrash has released a number of articles that’s put Valve squarely in cahoots with Oculus VR and not willing to make their own hardware, but instead contribute to the Rift.

I wonder if all that will change now, and if Valve regrets the free R&D and passive handover of employees to now a small piece of Facebook. It wouldn’t surprise me at all if Valve rethinks relying on Facebook and Oculus VR now and decide they’re going to create their own hardware instead.

LikeLike

Offering free R&D is always bad practice. Quite honestly, I hope Epson and CastAR decide to offer full HD resolution on their own devices, as they’re both going to be immensely more versatile than the Rift can ever hope to be.

LikeLike

My point exactly.

Poor late-night wording on my part. I had intended to write “may explain why Gabe Newell manoeuvreS clear of Oculus” – future tense intended, not past as given.

LikeLike

The IPO Investors via Kickstarter need to sue the hell out of Kickstarter, Oculus and Facebook. This is outright fraud and strips the investors of rights. Hopefully no one will give money to Kickstarter projects just for cheap t-shirt with a cheap decal on it.

LikeLike

I think they’d be better off suing their institutions of higher learning for failing to give them the slightest understanding of business finance. A Kickstarter campaign is NOT an IPO and doesn’t claim to be. The Kickstarter page for Oculus VR explains exactly what you’ll get for each level of “investment” and it’s pretty clear that what they get IS a cheap T-shirt, et al.

LikeLike

BS

It is an IPO launcher. Just because they use different wording and get out of offering investors company stock doesn’t change that fact.

This is outright fraud.

LikeLike

Methinks you misunderstand the term “IPO”.

An IPO is the sale of stock to the public on a securities exchange and underwritten. That is, it’s a stock market launch. A kickstarter most definely is not that. It’s a prviate fund-raising scheme, and that’s a wholly different kettle of fish. One can argue whether or not those who participated in the kickstarter for Oculus have been short-changed, received a kick in the pants or have got exactly what they were offered out of the deal, namely, goods in kind and an initial say in the direction of the product – all of which have been fulfilled. But claiming the kickstarter was in any way an IPO would seem to be hugely stretching the point.

LikeLike

No, it isn’t Inara and the sale of Oculus to Facebook proves it. Oculus used Kickstarter as venture capital without offering anything of worth to its mom and pop investors. THAT alone needs the SEC to come down on their asses along with Kickstarter.

This whole thing shows what scam it was and all played on the small investor tech fans. I hope the people burned have learned from this, never fund anything on Kickstarter again and start a class action lawsuit.

LikeLike

You’re potentially closer to the mark is referring to the kickstarter as venture capital. But that is still worlds away from it being anything like an IPO.

If you want to argue that the Oculus kickstarter funders have potentially short-changed, or that situations like this undermine the entire kickstarter process that’s fine. There are a number of valid arguments around these and on both sides of the equation. But trying to present a kickstarter as an IPO is shooting really, really wide of the mark and IMHO doesn’t do the discussion any favours.

LikeLike

No, you are just arguing semantics.

Oculus used Kickstarter as an IPO like offering without having to go through the proper channels (Securities Exchange) or normal Venture Capital avenues to avoid having to give away any ownership shares. And they succeeded in selling a private company without having to share equity. All of it funded by small investors who just received t-shirts. That needs to be examined because it is clearly wrong.

LikeLike

I’m not arguing semantics at all. Your entire premise that a kickstarter is an IPO is completely incorrect. If you can point to any point in the Oculus kickstarter page where people are offered the opportunity to purchase shares in the company, than you might have something. But saying someone is an “investor” in a company (start-up or otherwise) on the basis of buying a tee-shirt is ridiculous.

LikeLike

Crowdfunding campaigns like Kickstarter and Indiegogo are not IPOs. They’re – at best – venture capital. If you have a look at their definitions, you’ll see their entirely different beasts.

LikeLike

No it isn’t. IPO is a public offering to raise cash for the company. But they have to offer shares.

Oculus used Kickstarter as an IPO like offering without having to give up any kind of ownership. Open your eyes.

LikeLike

“Oculus used Kickstarter as an IPO like offering without having to give up any kind of ownership.”

No. They told people “look, we’re going to make this product and the API and we need you to pay us in advance to get a copy each.” The backers got their money’s worth – they got the product: Oculus Rift’s backers got the prototypes and a chance to give Oculus VR their feedback.

No one was promised that they were going to become board members or investors. That promise is nowhere to be found.

LikeLike

Like it or not Oculus has met the requirements of the Kickstarter campaign. They can do anything with the project after that, there is no fraud here, nothing is actionable. People payed an amount and got a reward, for small amounts it might be a tee shirt, for larger amounts prototype hardware or a meet and greet with the creators. Kickstarters Never promise a share of the company, that would be illegal.

You clearly have no idea what you are talking about, using terms you don’t understand, and then doubling down on them, as if that helps. Are a lot of people disappointed that a project they really wanted to belong to is now going to be yet another facebook property? Sure, everyone gets that. That does not mean something illegal happened? No, it seriously doesn’t.

LikeLike

If there was no problem there would be no amount of complaining on Reddit, Kickstarter or other technology blogs and websites. There is a problem. The deal and the whole Kickstarter business plan will have to be examined by federal authorities. A class action lawsuit is needed in order to create financial protections. Because right now, it even looks as if there was a bit of backroom trading of information.

I do know what I’m talking about, it is clear that most people here don’t know they are being asked to bend over.

LikeLike

The problem is that no one likes Facebook, and I don’t blame them. As for the rest, sorry, but that’s people’s sense of entitlement speaking.

LikeLike

You must have several links to where all the people that kicked in $5 for a tee shirt are getting together to get their legal share of that juicy $2 Billion. I know it’s only been a couple of days but the lawyers must be lined up to take this case, right? You keep using stock exchange terms as if they have anything to do with this. There were no shares sold, there was no IPO, Oculus Rift isn’t listed on any exchange. It is still a privately owned company and the owners can do anything they like with it.

Hurt feelings and complaining do not make for a legal case. The very simple fact is no one involved in the kickstarter phase of their funding was promised anything more than a gift for their donation. Give money to PBS, get a tote bag, not a share in PBS, or a vote in anything they do at that point. At most this is wake up call as to what a crowd-funding really is to people that gave money without an understanding of what that meant. Caveat emptor.

LikeLike

I think this matter has been pretty much beaten to death. As you and I (and others) have repeatedly pointed-out, the Kickstarter was a consumer transaction, not an investment transaction. I don’t think any amount of belabouring that point is going to dissuade others from their point-of-view.

Part of the problem here, I’d suggest, is some the terminology used with crowdfunders – particularly the use of the the word “backer”, which perhaps leads to a misunderstanding of the nature of the transaction taking place. In this, I do agree that there is much to be debated about how crowdfunders are presented and understood. There’s also a valid debate as to how the risk of such high-profile buy-outs might affect crowdfunding exercises in the future.

But both of these are quite distinct from any proclamations of “wrong doing” on the part of Oculus and / or FB.

LikeLike

So YOU were the one I saw outside the pet store yelling that the cat you bought wouldn’t pull a dogsled…

LikeLike

The big Kickstarter investors got developer kits. Glancing over the numbers, it’s hard to claim that they didn’t get fair value. It was a pre-order scheme for the hardware. But how did their contribution stack up as part of the total? When Facebook offered a couple of billion for the company, they ought to be able to give some reward.

And these people might be developing software,

It wouldn’t be crazy to send them the new generation hardware. Or, for the smaller contributors, a discount voucher for the retail version. I don’t think we know what will happen, but there is so much money being thrown around that it is practical for Oculus to do something like that.

LikeLike

My thoughts exactly.

LikeLike

I am reminded of the efforts to diversify at Linden Labs. Facebook acquiring Oculus is in some of the same business territory as Linden Labs acquiring Versu. Will the result be a success, or will we be dropped in it by something liken the Versu situation?

Big companies acquire small companies with novel ideas and products. And, frankly, there looks to be some silly money involved if you take the reports at face value. But the sums are so large that it feels unlikely that Facebook will ever simply give up.

LikeLike

Kill any competition before it goes to much or a sudden interest in virtual worlds again?

1st Cloud party and now the rift!

Will Yahoo create a virtual world? Will Facebook create a virtual 3d world?

Nevertheless its time for Linden Lab to realize the it needs to gather and keep your existent customers, happy cause “Times they are changing”.

LikeLike

I’m not sure how Yahoo will integrate its newest acquisition (the View-Master) with Cloud Party.

LikeLike